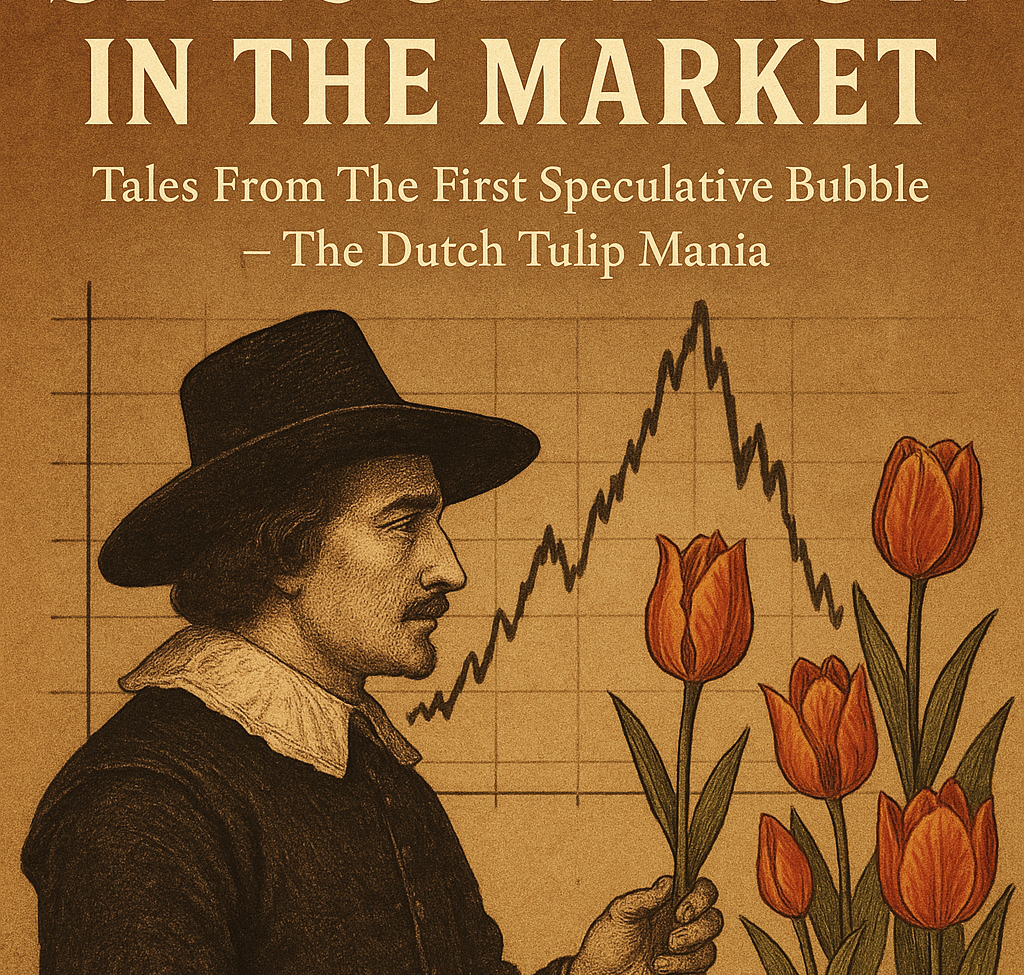

The Role Of Speculation in the Market: Tales From The First Speculative Bubble – The Dutch Tulip Mania

In the 17th century, the small yet influential country of northern Europe known as the Netherlands was living its golden age; from acquiring a sizable empire, and inventing the modern stock exchange to successfully building the first joint stock company – the Dutch East India Company. Amidst this flourishing historical moment, the brightly coloured flower that would come to be known as the country’s symbol, the Tulip, was introduced by Dutch merchants and brought back to the Netherlands and soon climbed the ranks of commodities establishing itself as the ultimate status symbol coveted by the affluent and influential. The market witnessed the emergence of tulip traders and middlemen all looking to make a profit from the tulip trade which quickly evolved into something more sophisticated and riskier. The introduction of futures contracts allowed buyers to guarantee to pay for bulbs at the end of the growing season, but the extravagant prices were not based on the tulips’ intrinsic value but instead on the speculation about their future worth and their anticipated value. Despite the difficulties that come with tulip harvesting such as their slow growth and restricted blossoming time, solid-coloured tulips remained affordable. What truly captivated the upper echelons of Dutch society were tulips characterized by a flame-like striping, which were just as rare as they were unusual, thus the new and exciting varieties of patterns in high demand and in short supply contributed to soaring prices, at one point as much as a grand canal house in Amsterdam. Thus, the Dutch Republic observed the emergence of an unprecedented occurrence — a market driven exclusively by speculation where prices soared beyond reason. The market, oversaturated to the breaking point with speculation, finally reached its culmination with the realization that tulips were, after all, just flowers and in no real shortage. The confidence that had once sustained the market’s high levels started to erode, and prices that had previously seemed certain to climb started to weaken. In 1637, auctions began to falter as purchasers became unwilling to part with outrageous sums of money for bulbs they might never see, bulb contracts began to lose value quickly, and the bubble that had taken years to grow burst in a matter of days. The aftermath was severe for those who witnessed their wealth vanish, but the Dutch economy demonstrated resilience, absorbing much of the impact. The Tulip Mania serves as a warning against excessive speculation and market volatility, and the echoes of the Tulip Mania can be observed in various financial bubbles throughout history and the more recent Bitcoin volatility and NFT bubble. These events serve as a reminder that despite changes in market participants and assets, the underlying human motivations remain unchanged.