THE COMPLEMENTARITY BETWEEN INVESTMENTS IN GOLD AND RISKY ASSETS: AN ANALYSIS OF POST-USA ELECTION DYNAMICS AND THE CRYPTOCURRENCY MARKET

Presidential elections, as a crucial phenomenon with macroeconomic impact, act as catalysts for transformations in financial markets, significantly influencing both risk perception and capital allocation strategies. The election of Donald Trump marked a turning point, bringing back up debates on the balance between safe-haven assets, such as gold and high-risk assets, like cryptocurrencies.

Gold, historically valued for its role as a reserve of value during periods of uncertainty, experienced a decline, reaching a two-month low,a phenomenon attributed to renewed economic optimism. Meanwhile, cryptocurrencies saw a sharp surge, with Bitcoin and other digital instruments hitting all-time highs, further increasing discussions about their systemic role in modern portfolios. This dichotomy in performance raises fundamental questions about the complementary nature of these two asset classes, highlighting the need for a comprehensive theoretical and practical analysis to define flexible investment strategies adaptable to macroeconomic fluctuations.

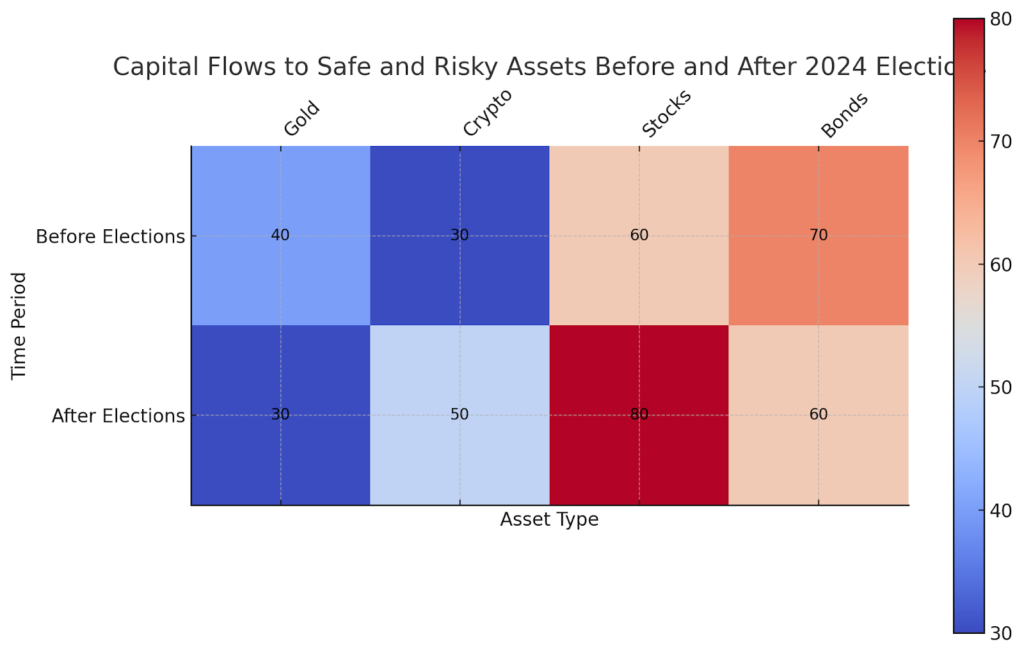

Illustration through a heatmap chart showing capital flow movements

Gold at Lows: A Response to Post-Election Optimism

The significant decline in gold prices observed after Donald Trump’s election in 2024 is emblematic of an economic optimistic context, driven by confidence in the pro-business policies promised by the new administration. The rhetoric of an “American economic revival,” characterized by proposals for further tax cuts, incentives for the manufacturing industry, and a deregulatory approach, has encouraged investors to redirect capital toward assets with higher return prospects, temporarily sidelining safe assets like gold.

The drop in gold, which reached a two-month low, does not signify a structural weakening of its economic function but rather a cyclical reaction driven by market sentiment. Gold, traditionally seen as a safeguard against macroeconomic and geopolitical uncertainty, inevitably experiences a contraction in demand during periods of economic optimism. However, this dynamic reflects a temporary equilibrium rather than a permanent shift in its systemic importance.

It is essential to note that the reduced appeal of gold does not imply the abandonment of its role in diversified portfolios. On the contrary, it underscores the importance of considering gold as a key element for risk management, capable of counterbalancing exposure to more volatile assets. In this context, gold demand is heavily influenced by risk perceptions, highlighting its inherently counter-cyclical nature. Therefore, the price decline represents a response to shifts in investor sentiment rather than a reduction in its strategic relevance.

The Rise of Cryptocurrencies: A New Financial Paradigm

Parallel to the decline in gold, the cryptocurrency market experienced rapid growth, with Bitcoin reaching new all-time highs, solidifying its position as the dominant asset in the sector. This was not an isolated event but the result of multiple factors: the increasing adoption of cryptocurrencies by institutional investors, the recognition of blockchain as a transformative technology for the economic system and an euphoric environment fueled by the narrative of innovation under the new Trump administration.

Unlike gold, cryptocurrencies stand out for their inherent volatility and return potential, making them particularly appealing to investors with a high risk tolerance and long-term investment horizons. This appeal is further amplified by their decentralized nature, positioning them as alternatives to the traditional financial system, especially in contexts of distrust toward fiat currencies.

However, the extreme volatility characteristic of the cryptocurrency market underscores the need for careful management with a diversified portfolio. Their inclusion should be calibrated to mitigate risks while maintaining a balance between exposure to extraordinary returns and protection against potential market corrections. Ultimately, cryptocurrencies represent a new financial paradigm, whose role in modern portfolios is set to evolve as their institutional recognition and regulation progress.

Complementarity Between Gold and Highly Volatile Assets and Its Implications for Portfolios

The interaction between gold and highly volatile assets, such as cryptocurrencies, is often described through the lens of inverse correlation. However, this representation oversimplifies a complex relationship that operates as a dynamic system influenced by macroeconomic factors, investor sentiment, and specific market contexts. During periods of economic optimism, investors tend to favor assets with potentially high returns reducing their exposure to more stable instruments like gold. Conversely, during times of uncertainty or volatility, gold reasserts its role as a cornerstone of capital preservation.

The analysis of the post 2024 election dynamics provides a particularly illuminating case study. Gold experienced a significant decline, reflecting an outflow toward assets perceived as more profitable, particularly cryptocurrencies, which during the same period attracted substantial capital inflows. However, this reallocation of capital should not be interpreted as competition between the two asset categories but rather as a demonstration of their complementarity. A strategically diversified portfolio would have enabled investors to capitalize the opportunities offered by the growth of cryptocurrencies while mitigating overall risk through the inclusion of gold, with its inherent ability to stabilize losses in adverse contexts.

A deep understanding of the complementarity between gold and highly volatile assets is a fundamental principle for investors focused on building portfolios capable of adapting to global market fluctuations. Strategic diversification, in fact, is not merely a defensive tactic but an essential component for maximizing the risk-return profile over the long term.

Allocation strategies can include:

- Dynamic allocation based on economic cycles: carefully monitoring macroeconomic and geopolitical conditions to flexibly adjust exposure to gold and risky assets. The use of predictive models enables capital distribution to be optimized in response to changing market contexts.

- Quantitative analysis of correlations: using statistical modeling tools to identify correlations between asset classes with the result of optimizing portfolio composition based on market dynamics. A data-driven approach allows the identification of opportunities and risks with greater precision and fairness compared to traditional techniques.

- Strategic integration of uncorrelated assets: Combining gold and cryptocurrencies with other uncorrelated assets, such as corporate bonds, private equity, real estate investments or other alternative investments. This multi-asset diversification enhances portfolio flexibility, balancing risk exposure with growth opportunities across sectors or regions.

Adopting a systematic approach to these strategies not only helps mitigate overall portfolio risks but also enhance a forward-looking and adaptive perspective, essential for navigating the complexities of an always evolving global financial markets context.

Comparison Between Gold and Bitcoin Performance Following the U.S. Elections

An Analysis of Electoral Dynamics and the Cryptocurrency Rally

The cryptocurrency rally following Donald Trump’s election in 2024 could generate both academic and practical debates about their role in contemporary investment portfolios. Institutional investor interest has continued to grow, with major financial sector players introducing dedicated funds and derivatives for cryptocurrencies. The Trump administration, through the approval of industry-friendly regulations, further bolstered market confidence, helping Bitcoin surpass the symbolic $90,000 threshold.

However, this enthusiasm has raised legitimate concerns about the risk of speculative bubbles. Historical analysis shows that despite their often extraordinary returns, cryptocurrencies remain highly vulnerable to regulatory changes and market sentiment. In this context, their complementarity with gold becomes particularly significant. Cryptocurrencies, with their high return potential, can serve as aggressive growth instruments, while gold acts as a stabilizing element, providing an essential safety net in the event of sudden corrections in highly volatile markets.

The Role of Monetary and Fiscal Policies

The 2024 elections took place within a global economic context characterized by divergent monetary policies. On one hand, the United States, under Trump’s leadership, pursued an expansive fiscal policy marked by stimulus measures aimed at supporting robust domestic economic growth. On the other hand many global central banks adopted restrictive monetary measures to cut inflation, creating a significant dichotomy that influenced international capital flows. This dynamic favored risky assets, often associated with higher returns, at the expense of safe assets like gold.

The situation was further amplified by the volatility of the U.S. dollar. A strong dollar made gold less accessible to foreign investors, reducing its demand, and at the same time favoring dollar denominated assets, including cryptocurrencies, which benefited from the favorable economic context. For global investors these developments underscore the importance of strategic portfolio management that takes into account the interplay between global economic policies and assets to optimize returns and mitigate risks associated with currency volatility.

Conclusion

The market performance following Donald Trump’s 2024 election highlights the urgency of a strategic and systematic approach to investment management and to the portfolio. Gold and risky assets such as cryptocurrencies, should not be seen as opposing options but rather as complementary elements in a diversified and adaptable portfolio. Analyzing their dynamic interactions,characterized by cyclical behaviors and sensitivity to macroeconomic variables, provides investors with a unique opportunity to effectively navigate the complexities of the global economic landscape while optimizing returns and mitigating risks across ever-evolving market cycles.